Table of Contents

Purchasing cryptocurrency without identity verification is possible through privacy-focused exchanges that prioritize user anonymity. This comprehensive guide walks you through everything you need to know about acquiring Bitcoin without KYC and other digital assets while maintaining your financial privacy. Whether you’re concerned about data breaches, value personal freedom, or simply want faster transactions, this tutorial covers all practical methods available in 2025.

The cryptocurrency industry was built on principles of decentralization and privacy. Yet many exchanges now require extensive identity documentation, creating barriers for users who prefer to keep their financial activities private. Fortunately, several legitimate options still exist for those who want to buy crypto without verification processes.

Why Buy Bitcoin Without KYC

Privacy-conscious cryptocurrency purchases protect your personal data from potential security breaches and unauthorized surveillance. The decision to buy Bitcoin without KYC verification stems from legitimate concerns about data security, personal freedom, and the original ethos of cryptocurrency.

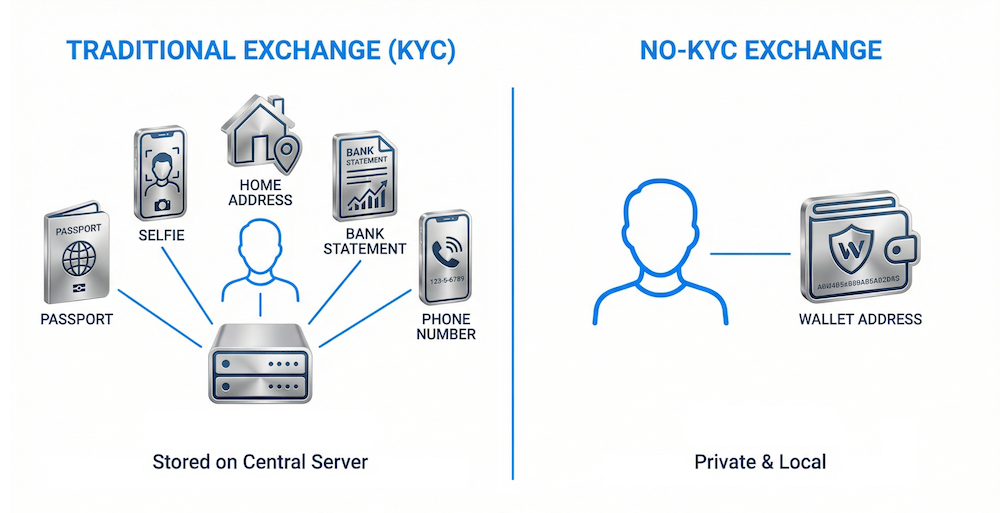

Understanding KYC in Cryptocurrency

Know Your Customer (KYC) protocols require exchanges to collect and verify user identities before allowing transactions. These regulations originated in traditional banking to combat money laundering and terrorist financing. Most centralized exchanges like Coinbase, Kraken, and Binance now enforce strict KYC requirements, asking users to submit government-issued identification, proof of address, and sometimes even selfie verification.

The process typically involves uploading passport or driver’s license images, utility bills showing your address, and waiting days or weeks for approval. For many users, this creates friction and raises concerns about how their sensitive data is stored and protected.

Legitimate Reasons to Avoid KYC

Multiple valid motivations exist for seeking cryptocurrency purchases without identity verification. Understanding these reasons helps contextualize why privacy-focused exchanges continue to serve an important market need.

Data Security Concerns

Cryptocurrency exchanges have suffered numerous high-profile data breaches. When you submit KYC documents, you’re trusting that company to protect your most sensitive information indefinitely. Breaches have exposed millions of users’ personal details, including passport numbers and home addresses.

Financial Privacy Rights

Many individuals believe financial privacy is a fundamental right. Just as you might prefer cash transactions for everyday purchases, some prefer cryptocurrency transactions without creating permanent records tied to their identity.

Geographic Restrictions

Residents of certain countries face banking restrictions or lack access to traditional financial services. For these individuals, no-verification crypto purchases may be their only pathway to participating in the digital economy.

Speed and Convenience

KYC processes can take days or even weeks to complete. Users who need to make time-sensitive purchases often prefer instant exchanges that don’t require verification delays.

Methods to Buy Crypto Without Verification

Several proven methods exist for acquiring cryptocurrency without submitting identity documents. Each approach offers different trade-offs between convenience, privacy, and available features.

Privacy-Focused Instant Exchanges

Instant exchange platforms enable fast cryptocurrency swaps without creating accounts or submitting personal information. These services operate by connecting users directly with liquidity providers, facilitating quick conversions between different digital assets.

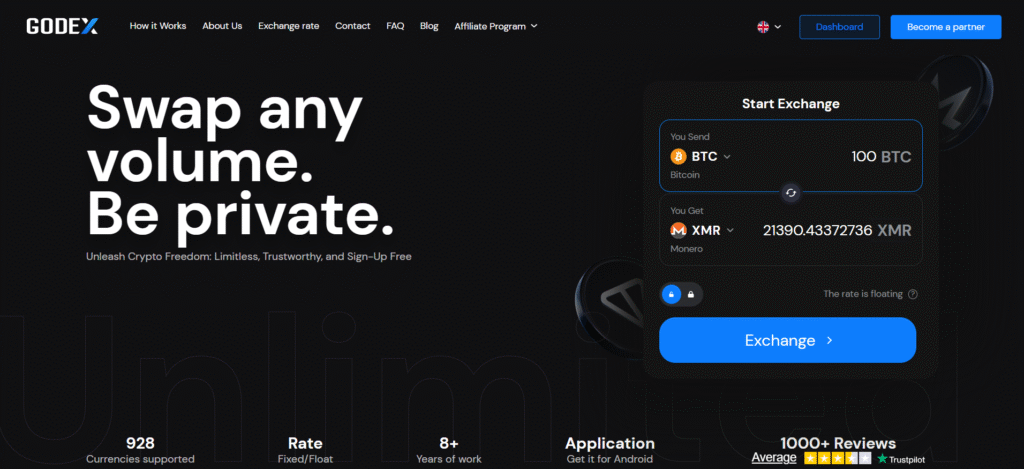

GODEX (godex.io) stands out as a high-privacy platform that supports over 920 cryptocurrencies. The service operates as an instant-access exchange where users can swap digital assets without registration requirements. Exchange rates are fixed for 30 minutes after order creation, protecting users from sudden market volatility during transactions.

The platform’s approach prioritizes user confidentiality while maintaining operational security. Transaction data is erased from servers within a week, and the service only retains minimal information necessary for support purposes.

Peer-to-Peer Platforms

Peer-to-peer (P2P) marketplaces connect buyers directly with sellers, often allowing transactions without platform-level verification. These decentralized approaches put you in control of negotiating terms directly with counterparties.

Popular P2P options include Bisq, a decentralized exchange that operates without central servers, and LocalCoinSwap, which facilitates direct trades between users. While some P2P platforms have introduced verification tiers, many still allow smaller transactions without identity requirements.

When using P2P platforms, exercise caution and trade only with reputable sellers who have established track records. Use escrow services when available, and start with smaller transactions until you’re comfortable with the process.

Bitcoin ATMs

Bitcoin ATMs provide physical locations where you can purchase cryptocurrency using cash or debit cards. Verification requirements vary significantly between operators and jurisdictions, with some machines allowing small purchases without identification.

Machines operated by companies like General Bytes or Lamassu often have higher limits for unverified purchases compared to others. However, be aware that many Bitcoin ATM operators have tightened verification requirements in recent years, particularly for larger amounts.

Fees at Bitcoin ATMs tend to be higher than online exchanges, often ranging from 5% to 15% above market rates. Consider this cost when deciding whether convenience and privacy justify the premium.

Decentralized Exchanges (DEXs)

Decentralized exchanges operate without central authorities, enabling cryptocurrency trading directly from your wallet without account creation. Platforms like Uniswap, SushiSwap, and PancakeSwap facilitate token swaps through smart contracts.

DEXs work by connecting your non-custodial wallet (such as MetaMask or Trust Wallet) directly to liquidity pools. You maintain control of your private keys throughout the process, and no personal information is collected.

The main limitation of DEXs is that they typically don’t support fiat-to-crypto purchases directly. You’ll need to already own some cryptocurrency to use these platforms, making them better suited for swapping between different tokens rather than initial purchases.

Step-by-Step Tutorial: Using GODEX to Buy Crypto Privately

This detailed walkthrough demonstrates how to exchange cryptocurrency using GODEX, a confidential trading platform. The process takes approximately 5-30 minutes depending on network confirmations.

Step 1: Prepare Your Wallets

Secure wallet preparation is essential before initiating any cryptocurrency exchange. You’ll need a wallet for the currency you’re sending and another for the currency you want to receive.

For maximum privacy, consider using non-custodial wallets that don’t require identity verification. Options include hardware wallets (Ledger, Trezor), desktop wallets (Electrum, Exodus), or mobile wallets (Trust Wallet, Atomic Wallet).

Ensure you have:

- Your destination wallet address ready (the wallet where you want to receive funds)

- Your sending wallet funded with the cryptocurrency you want to exchange

- Enough balance to cover both the exchange amount and network transaction fees

Step 2: Navigate to GODEX

Accessing the platform requires only a web browser and no account registration. Visit https://godex.io/ directly.

Important Security Note: Always verify you’re on the legitimate website by checking the security certificate in your browser. The URL should show a padlock icon and the correct domain. Never trust links from unsolicited messages or emails claiming to be from the exchange.

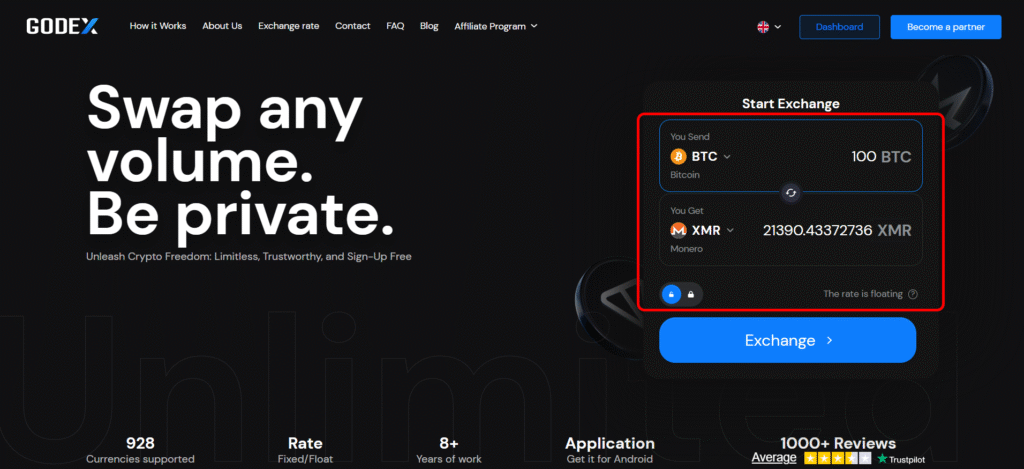

Step 3: Select Your Trading Pair

Choose the cryptocurrencies you want to exchange using the platform’s intuitive interface. The exchange supports over 920 different digital assets.

On the homepage:

- In the “You send” field, select the cryptocurrency you currently hold from the dropdown menu

- Enter the amount you wish to exchange

- In the “You get” field, select your desired destination currency

- The system automatically calculates the amount you’ll receive based on current market rates

- Choose between “Floating” or “Fixed rate” depending on whether you prefer market-adjusted pricing or a locked rate for 30 minutes

For example, to swap Bitcoin for Ethereum, select BTC in the first field, enter your amount, and choose ETH in the second field. The platform aggregates rates from major exchanges like Binance, Bitfinex, and HitBTC to provide competitive pricing.

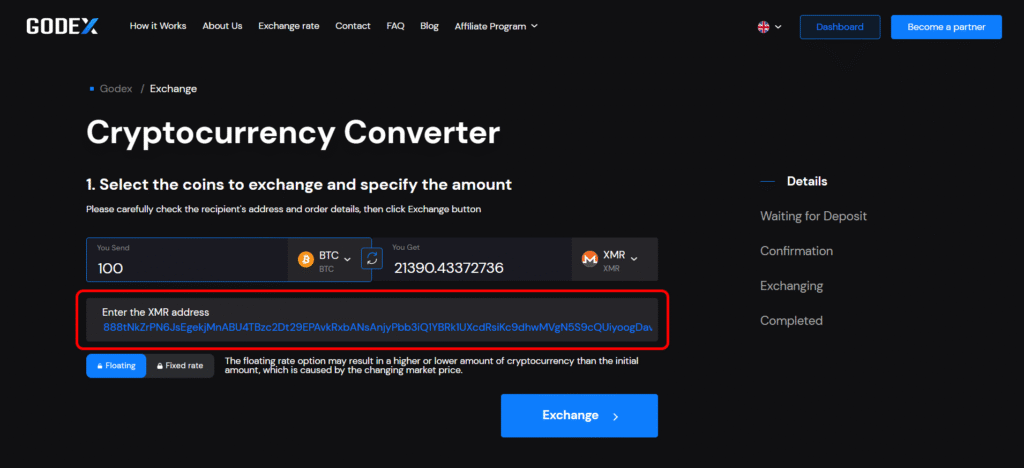

Step 4: Enter Your Wallet Addresses

Accurate wallet address entry is critical since blockchain transactions cannot be reversed once confirmed. Double-check every character before proceeding.

Fill in the “Destination address” field with your receiving wallet address. This must be a valid address for the cryptocurrency you selected in the “You get” field. For instance, if you’re receiving Ethereum, you need an ETH-compatible wallet address.

Optionally specify a refund address in the “Sender address” section. This address is used if the exchange cannot be completed for any reason.

Critical Warning: Some cryptocurrencies require additional identifiers like Payment ID (Monero), Destination Tag (Ripple), Memo (Stellar), or Message (NEM). If the exchange requests these extra fields, you must include them accurately. Failing to add required identifiers can result in permanent loss of funds.

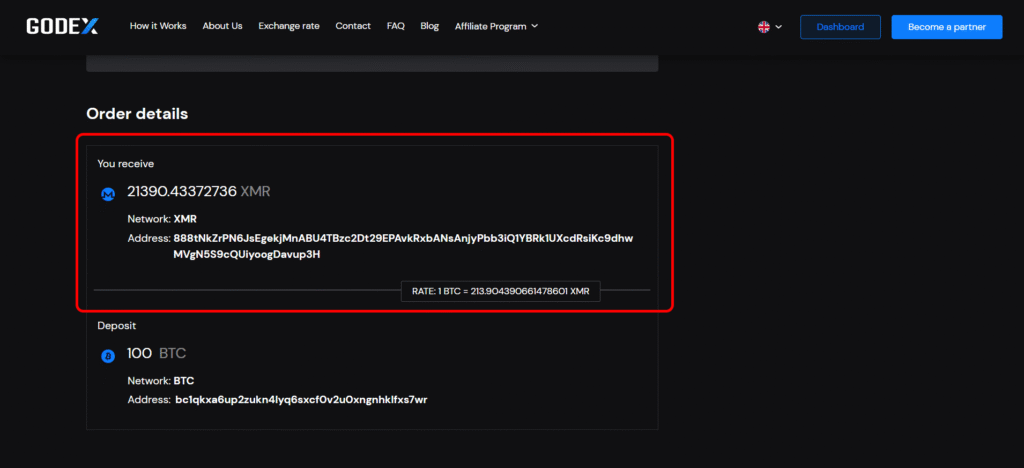

Step 5: Review and Confirm

Careful verification of all details prevents costly mistakes that cannot be undone. Take your time reviewing the transaction summary before clicking “Exchange.”

Verify the following:

- Correct sending and receiving currencies

- Accurate exchange amounts

- Destination wallet address matches your intended recipient

- Any required additional identifiers are entered correctly

- Exchange rate is acceptable to you

The exchange rate is fixed for 30 minutes from order creation. If your deposit doesn’t arrive within this window, the order may be cancelled or you may receive a different rate.

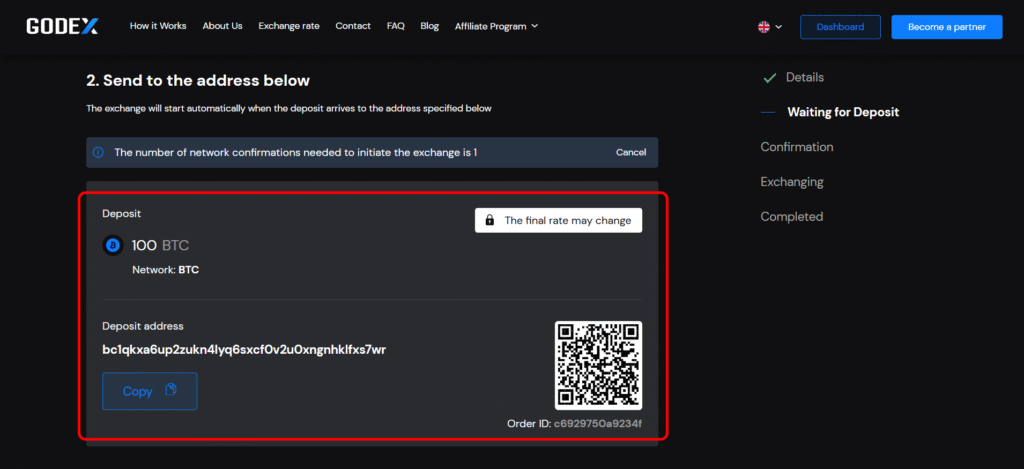

Step 6: Send Your Deposit

After confirmation, the platform generates a unique deposit address for your transaction. Send the exact amount specified to this address from your wallet.

Key points to remember:

- Send only the exact amount shown. Sending more or less may cause complications.

- Make only one deposit per Exchange ID. Multiple deposits require contacting support.

- Note your Order ID (format: #5bcfrd01e65ed) for tracking purposes.

- Set an appropriate network fee to ensure timely confirmation.

Step 7: Wait for Confirmation

Transaction processing typically completes within 5-30 minutes depending on network conditions and required confirmations. You can monitor progress using your Order ID.

Once your deposit appears on the blockchain, miners need to confirm the transaction. Different cryptocurrencies require different numbers of confirmations. Bitcoin typically needs 1-3 confirmations, while some altcoins may require more.

After confirmations complete, the exchange processes your order and sends the converted cryptocurrency to your destination wallet. You’ll see the transaction hash once your funds are dispatched.

Step 8: Receive Your Cryptocurrency

Your exchanged funds arrive in your destination wallet once the platform completes the conversion and blockchain confirms the outgoing transaction. Check your wallet to verify receipt.

The “Completed” page shows full transaction details including the amounts exchanged, rates applied, and transaction hashes for both the incoming and outgoing transfers.

Important Considerations When Buying Crypto Without KYC

Understanding potential limitations and best practices ensures successful private cryptocurrency transactions. While verification-free exchanges offer significant advantages, they also come with specific considerations you should understand.

Transaction Limits and Minimums

Most privacy-friendly exchanges have minimum transaction amounts to cover network fees and operational costs. These minimums vary by cryptocurrency and market conditions.

On GODEX, there are no upper limits for cryptocurrency exchanges. However, minimum amounts exist to cover blockchain miner fees. Deposits below approximately $30 equivalent may not be eligible for refunds if issues occur.

For larger volumes (more than 1 BTC equivalent), processing times may be slightly longer as the platform sources optimal liquidity.

Exchange Rate Considerations

Cryptocurrency prices fluctuate constantly, making rate timing an important factor in your transactions. Privacy-focused exchanges handle this volatility in different ways.

Fixed-rate exchanges lock in your rate for a specified period, protecting you from sudden market movements. However, if dramatic price changes (3% or more) occur during processing, some platforms may delay transactions or return funds.

Variable-rate exchanges offer rates that adjust until the moment of conversion. This can work in your favor during rising markets but may result in less than expected during downturns.

Security Best Practices

Protecting yourself when buying Bitcoin without KYC requires diligence and awareness of common threats. Follow these guidelines to minimize risks.

Verify Website Authenticity

Always type exchange URLs directly into your browser or use saved bookmarks. Phishing sites often create convincing replicas of legitimate exchanges. Check for HTTPS encryption and verify the exact domain spelling.

Use Secure Internet Connections

Avoid conducting cryptocurrency transactions on public Wi-Fi networks. If you must use public networks, employ a reputable VPN service to encrypt your connection.

Double-Check All Addresses

Clipboard-hijacking malware can replace wallet addresses you copy. Always verify at least the first and last several characters of any address before sending funds.

Start with Small Amounts

When using any new exchange or method for the first time, test with a small transaction before committing larger amounts. This confirms the process works correctly without risking significant funds.

Legal Considerations

Cryptocurrency regulations vary significantly by jurisdiction, and users bear responsibility for compliance with local laws. While using privacy-focused exchanges is legal in most regions, some countries have specific restrictions.

Certain platforms restrict access from specific countries. For example, residents of the United States, Cuba, Iran, North Korea, Syria, and other sanctioned territories may be prohibited from using some services.

Tax obligations typically still apply to cryptocurrency transactions regardless of whether verification was required. Consult with a tax professional in your jurisdiction to understand your reporting requirements.

Alternative Cryptocurrencies for Enhanced Privacy

Privacy-focused cryptocurrencies offer additional anonymity features beyond what Bitcoin provides by default. These coins implement various technological approaches to obscure transaction details.

Monero (XMR)

Monero leads privacy coins with mandatory stealth addresses, ring signatures, and RingCT technology that hide sender, recipient, and amount information. Every Monero transaction is private by default, making it nearly impossible to trace funds on the blockchain.

When exchanging on platforms like GODEX, remember that Monero transactions require a Payment ID in addition to the wallet address. Missing this identifier will result in lost funds.

Zcash (ZEC)

Zcash uses zero-knowledge proofs (zk-SNARKs) to enable fully shielded transactions where amount, sender, and recipient remain encrypted. Users can choose between transparent transactions (similar to Bitcoin) or shielded transactions for maximum privacy.

Dash

Dash offers optional privacy through its PrivateSend feature, which mixes transactions through a decentralized mixing protocol. While not as private as Monero by default, PrivateSend provides enhanced fungibility when activated.

Troubleshooting Common Issues

Understanding how to resolve common problems helps ensure smooth transactions even when issues arise. Here’s how to handle typical scenarios.

Delayed Transactions

Network congestion can slow transaction processing beyond typical timeframes. If your transaction is delayed, first check blockchain explorers to verify your deposit was sent and has confirmations.

Low transaction fees often cause delays, especially on busy networks like Bitcoin or Ethereum. If your transaction is stuck, some wallets allow fee bumping (RBF for Bitcoin, gas price increase for Ethereum) to accelerate confirmation.

Wrong Amount Sent

Sending incorrect amounts complicates transactions but is usually recoverable. If you sent more than required, contact customer support with your Order ID to arrange proper crediting or refund.

If you sent less than the minimum amount, the transaction may not process. Amounts under approximately $30 equivalent typically cannot be refunded due to network fee considerations.

Missing Additional Identifiers

Transactions sent without required Payment IDs, Memos, or Destination Tags may be difficult or impossible to recover. If you realize you’ve forgotten an identifier, contact support immediately with all available transaction details.

Prevention is key: always carefully read all instructions before sending funds. If the exchange interface shows fields for additional identifiers, assume they’re required unless explicitly stated otherwise.

Comparing Privacy-Focused Exchange Options

Different instant exchange platforms offer varying levels of privacy and features. Understanding these differences helps you choose the right service for your needs.

Key Factors to Evaluate

When selecting an identity-light exchange, consider these important factors:

Verification Requirements

Some platforms advertise as “no KYC” but may request verification for suspicious transactions, large amounts, or certain jurisdictions. Research actual user experiences and current policies before committing to a platform.

Supported Cryptocurrencies

Coin selection varies dramatically between platforms. GODEX supports over 920 cryptocurrencies, while some competitors offer only a few dozen. If you need specific altcoins or privacy coins, verify availability before choosing a platform.

Rate Competitiveness

Exchange rates and fees impact the total value you receive. Compare rates across multiple platforms for your specific trading pair. Remember that the cheapest rate isn’t always best if it comes with verification requirements or reliability concerns.

Track Record and Reputation

Established platforms with years of operation and positive user reviews present lower risk than new entrants. Look for exchanges that have been operating since at least 2018 and have consistent feedback from real users.

Why GODEX Stands Out

GODEX (https://godex.io/) has operated as a privacy-friendly exchange since 2018, building a reputation for reliability and user confidentiality. The platform offers several distinctive advantages:

- Extensive coin selection: Over 920 cryptocurrencies including all major privacy coins

- No registration required: Start exchanging immediately without creating accounts

- Data minimization: Transaction data erased from servers within one week

- Fixed rates: 30-minute rate lock protects against volatility

- No limits: No maximum exchange amounts

- Competitive rates: Aggregates liquidity from major exchanges like Binance, Bitfinex, and HitBTC

- 24/7 support: Customer assistance available around the clock

Maintaining Privacy After Your Purchase

Buying crypto without verification is only the first step in maintaining financial privacy. How you handle, store, and use your cryptocurrency afterward matters equally.

Wallet Security

Non-custodial wallets keep your private keys under your control, essential for true privacy and security. Hardware wallets offer the strongest protection by storing keys offline.

Back up your seed phrase in multiple secure locations. Never store seed phrases digitally (no photos, no cloud storage, no email). Consider using metal backup plates for fire and water resistance.

Transaction Privacy Techniques

Several techniques can enhance transaction privacy beyond just buying without KYC verification.

- Use new addresses: Generate fresh receiving addresses for each transaction

- Avoid address reuse: Using the same address multiple times links your transactions

- Consider CoinJoin: Bitcoin mixing services can break transaction chains

- Use privacy coins: Convert to Monero or other privacy coins for enhanced anonymity

- Lightning Network: Bitcoin’s Layer 2 offers improved privacy for smaller transactions

Operational Security

Your digital habits can undermine transaction privacy even when using anonymous purchasing methods. Practice good operational security.

- Use a VPN or Tor when accessing cryptocurrency services

- Clear browser cookies and use private browsing modes

- Don’t discuss holdings on social media

- Be cautious about connecting wallets to dApps that may log your activity

- Use separate email addresses for cryptocurrency-related accounts

Conclusion

Purchasing cryptocurrency without identity verification remains accessible through privacy-focused instant exchanges, P2P platforms, and Bitcoin ATMs. Each method offers different trade-offs between convenience, privacy, and costs.

For most users seeking to buy Bitcoin without KYC or exchange other cryptocurrencies privately, instant exchanges like GODEX offer the optimal balance of speed, selection, and confidentiality. With support for over 920 cryptocurrencies, no registration requirements, and a track record dating back to 2018, the platform serves as a reliable option for privacy-conscious traders.

Remember that privacy is a continuum, not a binary state. The purchasing method is just the beginning. Follow through with good wallet security, thoughtful transaction practices, and solid operational security to maintain your financial privacy throughout the lifecycle of your cryptocurrency holdings.

Whether your motivation stems from data security concerns, philosophical beliefs about financial freedom, or practical needs like faster transactions, legitimate options exist to acquire cryptocurrency on your own terms. Start with small test transactions, verify everything carefully, and gradually build confidence with any new platform or method.

Ready to make your first private cryptocurrency exchange? Visit https://godex.io/ to get started in minutes without any registration or identity verification requirements.

Frequently Asked Questions

1. Can I buy crypto without KYC?

Yes, privacy-focused instant exchanges, P2P platforms, Bitcoin ATMs, and DEXs let you purchase cryptocurrency without identity verification.

2. Is it possible to buy Bitcoin without KYC?

Absolutely. Use instant-access exchanges, peer-to-peer marketplaces, or Bitcoin ATMs that allow purchases without submitting personal documents.

3. Which crypto platform has no KYC?

GODEX operates as a privacy-friendly exchange supporting 920+ coins without registration, offering instant swaps with minimal data collection.

4. Is non-KYC legal?

Yes, buying crypto without verification is legal in most jurisdictions. However, tax obligations still apply regardless of purchase method.

5. What crypto does not use KYC?

Privacy coins like Monero, Zcash, and Dash offer enhanced anonymity features. They’re available on most instant exchanges without verification.

Start a Cryptocurrency exchange

Try our crypto exchange platform

Disclaimer: Please keep in mind that the content of this article is not financial or investing advice. The information provided is the author’s opinion only and should not be considered as direct recommendations for trading or investment. Any article reader or website visitor should consider multiple viewpoints and become familiar with all local regulations before cryptocurrency investment. We do not make any warranties about reliability and accuracy of this information.

Alex Tamm

Alex Tamm

Read more

The world of cryptocurrency can feel overwhelming when you’re just starting out. With thousands of digital assets, dozens of platforms, and an entirely new vocabulary to learn, many newcomers find themselves paralyzed by choice and confusion. But here’s the truth: exchanging cryptocurrency doesn’t have to be complicated. This comprehensive guide will walk you through everything […]

Pakistani traders now have access to multiple cryptocurrency exchanges that offer secure trading, diverse digital assets, and accessible payment methods. Pakistan has emerged as one of the world’s fastest-growing crypto markets. With an estimated 15–25 million crypto users (some sources project 27M+ by 2025), the country ranks among the top nations for digital asset adoption. […]

Finding a cryptocurrency exchange with lowest fees directly impacts your trading profits. Every percentage point saved on fees means more crypto stays in your wallet. Whether you’re a day trader or long-term holder, fee structures matter. This guide covers the top platforms where you can trade crypto without overpaying. We’ve analyzed trading fees, withdrawal costs, […]

Finding a reliable crypto exchange in Pakistan presents unique challenges due to ongoing regulatory uncertainty. Despite the State Bank of Pakistan’s 2018 directive and subsequent 2024 reinforcement declaring crypto transactions illegal, millions of Pakistanis continue participating in digital asset markets through international platforms. This comprehensive guide examines eight cryptocurrency exchanges in Pakistan’s market, helping traders […]

The United Arab Emirates has emerged as the world’s leading cryptocurrency hub in 2025. With zero personal income tax on crypto gains, clear regulatory frameworks, and a thriving digital economy, the UAE attracts traders and investors from around the globe. This comprehensive guide covers everything you need to know about using a crypto exchange in […]

Privacy-focused Bitcoin trading is becoming essential as financial surveillance increases globally. The original vision of Bitcoin included financial sovereignty and pseudonymous transactions. However, as cryptocurrency entered the mainstream, centralized exchanges implemented strict Know Your Customer (KYC) requirements. These identity verification procedures now resemble traditional banking more than the decentralized future Satoshi Nakamoto imagined. For those […]